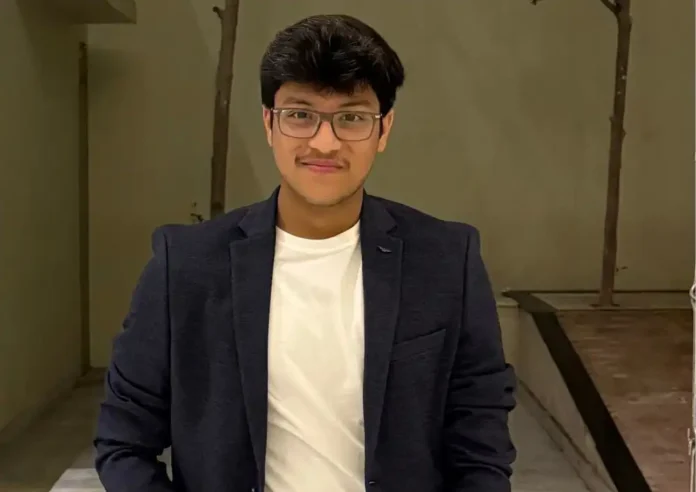

When markets fluctuate wildly in response to policy shifts, inflation shocks, or geopolitical triggers, learning how to stay disciplined in volatile markets has never been more crucial. For Aryan Khandelwal—a finance content creator and equity research analyst—this turbulence is nothing new. What’s changed, he says, is the sheer volume of information and the speed at…

RELATED ARTICLES

© NewInAsia.com 2025